How To Make Stock Market Volatility Work for You?

Stock day traders actually want stock market prices to make big moves. A stagnant market where prices don't move or move in very small increments means that money invested in such a market is "dead money".

When stock prices are volatile even a stock with a price that ends down from the prior day can make winning moves during the current trading day (intraday) before ending down at the end of the day. An investor buying a stock close to its intraday low and then selling it after the price rises intraday can make a profit. The trick is finding stocks with such a trade set up.

What are the characteristics of a profitable intraday stock?

Volatility over multiple days backed by sufficient volume that shows there is trader interest in the stock. The volatility has to be over multiple trading days with moderate to big price movement taking place during each trading day. The research to find such stocks is already done for you on the watchlists in the Most Excellent Investor membership area.

The psychology needed to trade a volatile market?

Even after finding volatile stocks that meet the criteria for volume a trader needs to have the "guts" to buy into a stock position and hold that position long enough for the price to rise during the trading day. Because after buying a stock at what can be considered a comparatively low price that price can drift even lower before rising above the purchase price. Check out the case study of the stock below from March 23, 2022.

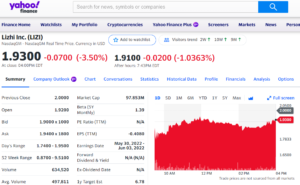

Case study profitable intraday winning stock: Lizhi Inc. (LIZI)

Buying stock symbol LIZI at 9:34 AM on March 23, 2922 for $1.78 would earn a profit of between 1.8% - 9.5% if sold anytime between 9:38 AM and 11:56 AM. A profit of between 3.5% and 8.4% could be made if the position was closed (sold) anytime after 11:56 AM.

Every day there are dozens, if not hundreds, of stocks that trade with sufficient volatility like the case study shown above. With proper stock research and trader mentality a volatile market will make opportunity for big profits!